September’s Delayed Jobs Report Delivers a Mixed Message

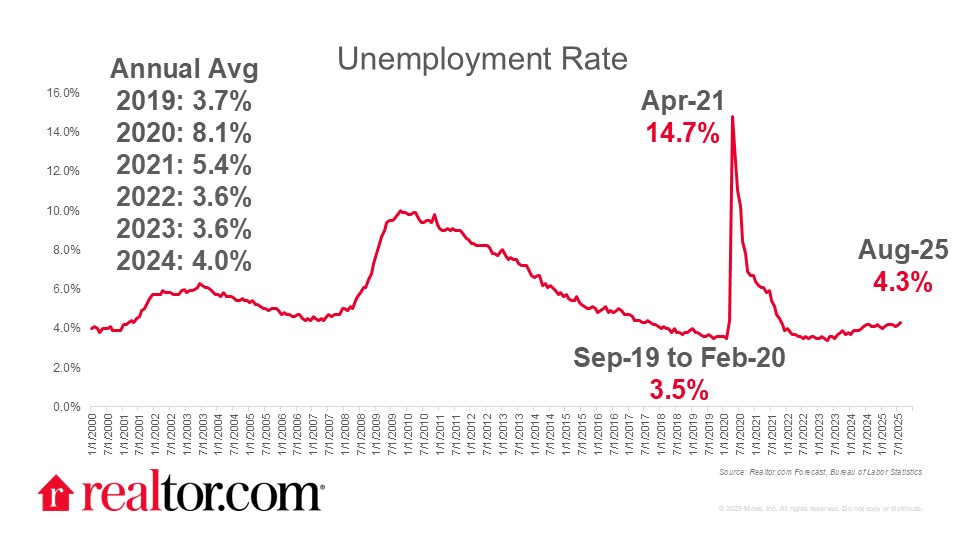

The delayed and once-highly-anticipated September jobs report showed the economy added 119,000 jobs compared to the previous month, much higher than the 50,000 that economists had forecast. Unemployment, on the other hand, rose to 4.4% (4.44% unrounded) higher than anticipated, while wage growth stayed modest – ticking up just 0.2% month over month.

In some ways, this report fills in the blanks for where the labor market stood in late summer. But because this is the last official labor data the Fed will see before the December FOMC meeting, its interpretation may matter more than the numbers themselves.

A Divided Fed Faces a Rorschach Test Ahead of December Meeting

The report may function as something of a Rorschach test for a deeply divided Fed and for markets that had been predicting a December cut was slightly less likely than the FOMC standing pat. Inflation hawks will point to still-solid payroll gains and wage growth running at nearly 4% annually as evidence that the Fed should avoid cutting again too soon. Doves will counter that the unemployment rate is finally showing some troubling signs: edging toward 4.5% in September may mean we are already there right now in mid-November, let alone December.

What the Labor Market Signals Mean for Mortgage Rates and Housing

For housing heading into late 2025 and early 2026, today’s numbers matter in two key ways:

First is the path of monetary policy and mortgage rates. November/December is a slower season for transactions, but buyers and sellers are already looking ahead to spring. A softer-but-steady jobs report slightly increases the odds of a December Fed cut, which could bring modest rate relief. Even small declines help buyers’ affordability and may ease the lock-in effect for sellers as market rates move closer to their existing mortgages.

Second is the underlying strength of the labor market. Unemployment holding at 4.4% would be a welcome development. But the upward drift and downward revisions warrant attention. If unemployment continues to rise, that could weigh on buyer confidence. Conversely, if job growth firms up and inflation stays contained, wage gains could translate into real purchasing-power improvements, just as rates move lower.

In short, today’s report keeps the housing outlook tied to two trends: where mortgage rates go next and whether the labor market softens further or stabilizes.

Subscribe to our mailing list to receive updates on the latest data and research.